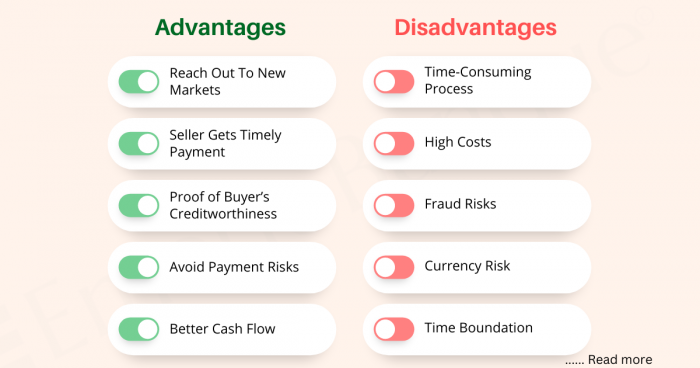

Advantages and Disadvantages of Letter of Credit in Global Trade

A letter of credit provides a financial backdrop to both the buyers/importers and overseas suppliers ie. sellers/exporters in cross-border trade transactions by ensuring that the payment will be made on time.

Before using an international letter of credit, it is important to consider its advantages and disadvantages. Let’s find it in detail:

What is a Letter of Credit?

A letter of credit is a legal document issued by a bank or a private institution guaranteeing that a buyer will pay the seller on time and for the correct amount of goods & services ordered. In the event, that the buyer defaults or is unable to pay, the issuing bank will compensate the full or remaining amount to the seller.

It is one of the most & frequently used global trade finance instruments in cross-border trade transactions used by sellers and buyers to avoid payment failure while importing and exporting. It is a highly customizable and effective form that can reduce credit risks. Let’s see how it works.