Connect with a Financing Company in Your Area in One Step

In today’s volatile business environment, capturing opportunities and developing your operations frequently demand a strong financial foundation. Whether you’re a startup hoping to get started, a small business looking to expand, or an established firm needing to replace your equipment, getting the appropriate financing is critical. This is where a Financing Company Near Me will help you achieve your financial goals. In this blog article, we’ll go into the realm of finance firms and look at how they might help you succeed.

The Search for Financial Assistance

As a business owner, you may come across situations when finance is required urgently. Having access to finance solutions may make all the difference when it comes to acquiring new equipment, expanding your facilities, or managing cash flow during difficult times. Finding the proper spouse, on the other hand, is frequently easier said than done. This is when the terms “Financing Company Near Me” come in handy.

What exactly is a Financing Company?

In essence, a finance firm is a corporation that specializes in supplying businesses with the funds they require to achieve their financial obligations. These businesses provide a wide range of financial solutions that are suited to specific company needs. This comprises loans, credit lines, equipment finance, and a variety of other services.

The benefit of working with a local lending firm is the personal touch they bring to the table. They are familiar with the area economic context, as well as the issues that local firms confront, and can give tailored financial solutions.

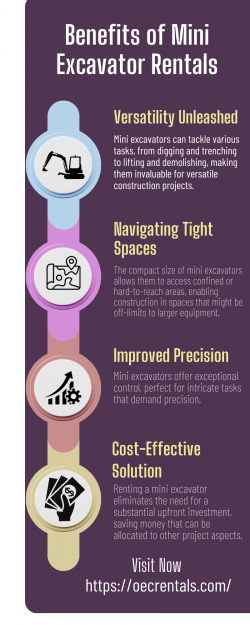

The Advantages of Working with a Local Financing Company

Now, let’s look at why choosing a Financing Company Near Me is a good idea.

1. Proximity and Accessibility: Choosing a local finance firm provides you with quick access. You may arrange face-to-face meetings to discuss your financial requirements in depth and establish a solid working relationship. This degree of accessibility may be quite beneficial, particularly during key business choices.

2. Knowledge of Local Market characteristics: Local finance businesses understand the particular characteristics of your area’s company landscape. They can offer insights and suggestions that are relevant to your locality, allowing you to make more educated financial decisions.

3. Rapid Decision-Making: Local finance businesses frequently make decisions faster than huge national organizations. When you need rapid access to funds to capture an opportunity or manage an urgent financial crisis, this agility may be a game changer.

4. Community Connection: Supporting local businesses is a commitment to developing a stronger community, not merely a trend. When you work with a Financing Company Near Me, you help to expand and thrive your local economy.

Investigating Financing Options

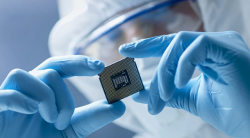

A lending Company Near Me provides a number of lending alternatives to meet your individual requirements. Equipment financing is one such possibility. This option enables you to obtain the machinery and tools required for your business operations while without depleting your working capital.

Nearby Equipment Financing

Equipment financing is very advantageous in companies where machinery and technology are critical. Whether you own a manufacturing plant, a construction firm, or a technological startup, having the most up-to-date equipment may boost your productivity and competitiveness dramatically.

You may stretch the expense of equipment purchasing over time with equipment financing, making it more manageable for your organization. Furthermore, the equipment itself frequently acts as collateral, eliminating the need for additional assets or personal guarantees.

Finally, if you’re looking for financial assistance to fuel your company dreams, consider contacting a Financing Company Near Me. Their local knowledge, specific solutions, and dedication to your success can serve as a link between where you are now and where you want to be tomorrow. So, take that critical step and investigate the money prospects that are available in your own backyard. Your company’s success story might be as close as a handshake.