Increase Business Speed with Equipment Financing Options

Do you want to hasten the growth of your company but lack the resources to make an equipment purchase? It’s possible that equipment financing will work for you. Businesses can use this financial option to get the equipment and resources they require without having to pay a sizable upfront sum of money. We’ll discuss the advantages of financing equipment, how it functions, and what kinds of equipment qualify. Let’s delve in and examine how this choice might help advance your company.

The advantages of financing for equipment

Businesses now frequently use equipment financing to purchase the essential tools and equipment without having to pay a sizable upfront sum of money. There are several advantages to using this type of financing, and businesses who need expensive machinery or technology may find it very helpful.

Businesses may preserve their cash thanks to equipment financing, which is a huge benefit. They can invest those earnings in other things instead of investing a lot of money on new equipment, like marketing plans or recruiting additional employees.

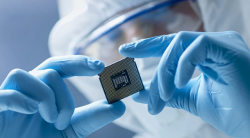

Furthermore, equipment financing enables companies to access cutting-edge technology without worrying about obsolescence. Companies can regularly improve their machinery by leasing rather than outright purchasing, ensuring that they always have the most cutting-edge resources accessible.

The equipment financing procedure

Equipment financing is an easy and simple process to comprehend. A business owner often starts by identifying the equipment they need to buy and estimating its cost. The business will next get in touch with a lender or lease business that specializes in financing equipment.

The lender will then assess the borrower’s creditworthiness and decide whether or not they qualify for loan. Examining elements including collateral, cash flow, and credit score are part of this review.

Equipment types that can be financed

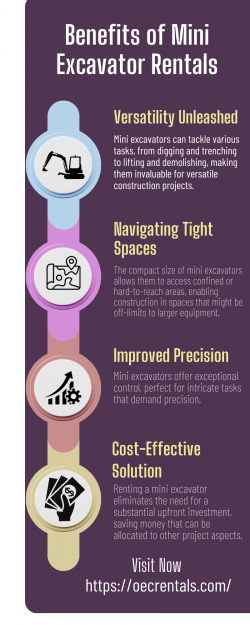

Businesses wishing to grow and expand can completely change the game by utilizing equipment lease solutions. Business owners are able to retain cash flow and maintain financial stability by offering access to critical equipment without having to pay the whole amount up front.

These financing options can be used to fund a wide range of equipment, including transportation vehicles, building equipment, medical supplies, computer hardware and software, manufacturing tools, and much more. It’s critical for firms to comprehend their unique requirements in order to select the best financing choice.

For More Info:-https://www.equifyfinancial.com/