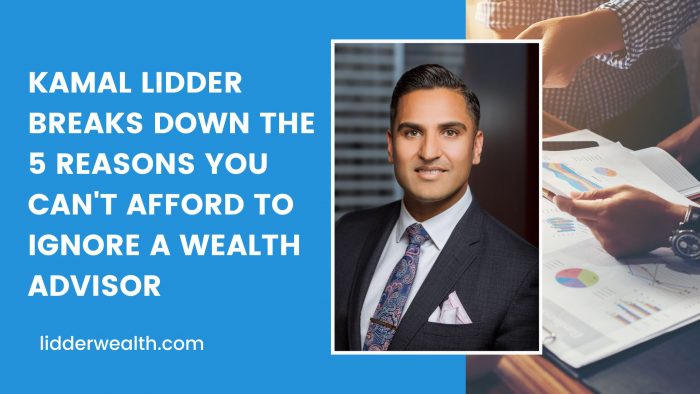

Kamal Lidder Breaks Down the 5 Reasons You Can’t Afford to Ignore a Wealth Advisor

In the ever-evolving landscape of personal finance, the significance of seeking professional guidance can’t be overstated. Kamal Lidder, a seasoned wealth advisor, is here to shed light on why ignoring the expertise of a financial professional could be a costly mistake.

If you’ve ever wondered about the benefits of having a wealth advisor by your side, buckle up as we break down the reasons that make this collaboration indispensable.

Navigating Financial Complexity

The financial world can be a labyrinth of complexities, with investment options, tax regulations, and market trends constantly changing. Kamal Lidder emphasizes that a wealth advisor serves as your compass, helping you navigate through the intricacies and ensuring that your financial ship sails smoothly.

From investment strategies to tax planning, their expertise can make all the difference in achieving your financial goals.

Tailored Strategies for Your Unique Goals

No two individuals have the same financial goals, risk tolerance, or life circumstances. Kamal Lidder stresses the importance of personalized strategies crafted by a wealth advisor.

By understanding your unique situation, a wealth advisor can develop a tailored plan that aligns with your objectives, whether it’s saving for retirement, buying a home, or funding your child’s education.

Mitigating Risks and Maximizing Returns

Investing always involves a level of risk, and making informed decisions is crucial. Lidder points out that wealth advisors are well-versed in risk management, employing strategies to mitigate potential pitfalls while maximizing returns. Their insights can be instrumental in making well-informed investment decisions that align with your risk appetite.

Staying Proactive in a Dynamic Market

Markets are dynamic and subject to speedy modifications. Kamal Lidder emphasizes the significance of having a proactive approach to economic management. Wealth advisors live abreast of market tendencies, economic shifts, and regulatory adjustments, ensuring that your financial plan remains agile and adaptive to the evolving landscape.

Time is Mone

Managing price ranges calls for time and determination. Lidder notes that with the aid of delegating the responsibility to a wealth advisor, you lose valuable time to consciousness in your passions, career, and personal existence. Professional guidance no longer only saves time but additionally provides a laye

Final Words

In a global economy in which monetary choices have far-reaching consequences, Kamal Lidder makes a compelling case for the fundamental role of a wealth advisor. The benefits go beyond mere wealth accumulation; they encompass a comprehensive approach to economic well-being.

Don’t let ignorance be the stumbling block to your financial success; associate with a wealth advisor and embark on a journey closer to financial prosperity and peace of mind.