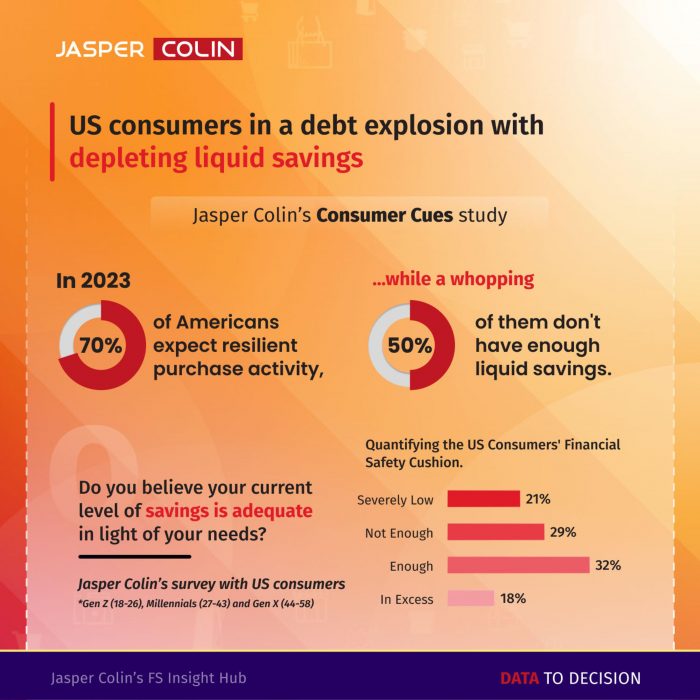

US consumers in a debt explosion with depleted liquid savings

While the federal debt exceeds 120% of GDP, the savings-minded US consumer has been spending like never before. Some attribute this spending spree to post-covid fiscal stimulus packages. At the same time, experts are concerned that the growing deficits will erode market confidence in the Treasury amid repayment uncertainty. According to Jasper Colin’s study, volatility-oriented returns are expected to extend into this year’s markets despite a savings-loving economy on a spending spree. Despite the constant layoffs across sectors, consumer sentiment is surprisingly upbeat, notwithstanding the interest rate hikes.